Car Purchase Journal Entry

Answer 1 of 4. Check out the bookkeeping entries for the purchase and financing of a vehicle.

Accounting Basics Purchase Of Assets Accountingcoach

Claiming HST paid for the purchase of a vehicle is complex.

. Based on what youve mentioned the purchase price is a total of 35500 and the only gst cost is 302364 Id double check this as your car licence papers will have a stamp duty and gst component. A note then the journal entry will be. Accountant and GST Practitioner.

The HST is not normally related to the debtfinancing of vehicle but rather the purchase of the vehicle. Also the vehicle is an asset. The car needs to have a tax code of CAP or GCA depending on your version of MYOB Stamp duty has a tax.

1Quantity 2 Rate per Kg 3 Excise Duty Direct or Input as such 4 VATCST. Since this is a loan that is a part of the purchase price you can create a. Go to the New button.

It simply means the company sells an old car for 20000 and buys a new car that costs 100000. If you purchased the vehicle with 100 financing ie. Create a new purchase order for the car.

The importance of this is so that your CPA knows when to start the depreciation of that loan. Above entries are applicable when Invoice address GSTN is in the name of firm. Gstin number is also in the invoice.

ABC has the option to trade in the old car for a discount of 20000 on a new car. Before passing entries you need to cross check the purchase entry with invoice in following areas-. You put up 3000 cash and take a 12000 loan.

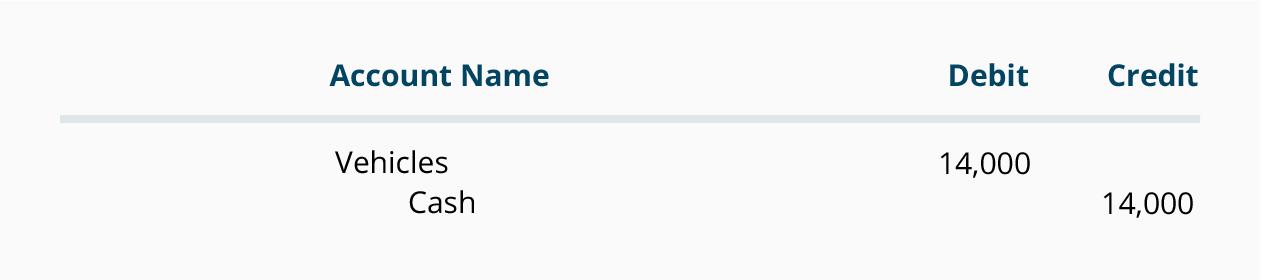

At the same time you can transfer money from an asset liability or equity to an income or expense account. Debit vechile for the cost Credit Note payable for the cost. Purchased a car for 2000 in cash.

In our next topic i am going to explain how to pass journal entry for Purchase return in different scenarios. There are special rules on how to claim your input tax credits related to a vehicle purchase. Debit vehicle for the cost credit cash for the amount paid credit the note payable for face amoun of the note.

They end up paying 80000 only. Journal Entry for Hire Purchase At the beginning of the hire purchase buyer pays for the initial deposit which depends on the agreement between both parties. The person to whom the money is owed is called a Creditor and the amount owed is a current liability for the company.

When you purchase the car you make a journal entry for the purchase of a fixed asset on credit and more likely youll make several journal entries. Purchase of equipment journal entry. For example assume youre a plumber paying 15000 for a used pick-up truck you can use to haul equipment and supplies to jobs.

9588000 2nd when you paid down payment It. You can create a journal entry to record the purchased vehicle transaction in QuickBooks Online. Return to our main tutorial Journal Entry for Asset Purchase.

2 Date of purchase invoice. Purchase Credit Journal Entry is the journal entry passed by the company in the purchase journal of the date when any inventory is purchased by the company from the third party on the terms of credit where the purchases account will be debited and the creditors account or account payable account will be credited in. With Journal Entry you can transfer money between income and expense account.

When you purchase equipment with the intention of keeping it for more than one year youre not just making one journal entry recording the purchase You also need to make journal entries to reflect depreciation. Purchasing a car paid by cheque Car ac dr To Bank ac Car is a real ac and asset comes in so debited Bank is a personal ac and bank is giver. The difference between bank loans and vehicle loans is that.

Depends on how the car was financed there are always variables DR Motor Vehicle DR Hire purchase Interest current asset CR Hire Purchase company I suspect this method is used so that the accountant does not forget to write off the HP charges. Prasad Nilugal Sr. It is not the discount but the net off of old car value for a new car.

If you put a down payment on the vehicle then the journal entry is. Name of party account Creditor under loan liabilities Accepts all one by one and then return to gateway of tally and pass the voucher entries in Account voucher When you buy the Car on credit This entry will be in Journal voucher F7 function key Car account debit BD. And here youre going to do a journal entry.

9588000 Name of party from where you buy Credit BD. Record the journal entry for the following transaction. And make an equipment journal entry when you get rid of the asset.

Youre going to date it ie. Buyerlessee has the obligation to pay the installment in exchange for the right to use the underlying asset. A car is an asset so the journal entry for it will be similar for the purchase-via-loan of other assets like workshop equipment.

Were going to go up to the plus sign. Cash Purchase of Vehicle. Please seek advice to your accountant so that youll be guided with the correct account to use when creating a Journal entry.

With bank loans the business receives actual money into the bank account and. Input the date of the vehicle purchase. Prasad Nilugal Sr.

What is the Purchase Credit Journal Entry. Please journal entry for a trade-in vehicle. Under OTHER select Journal entry to record this transaction.

Purchase Credit Journal Entry is the journal entry passed by the company in the purchase journal of the date when the company purchases any inventory from the third party on the terms of credit where the purchases account will be debited. OR you can omit the HP Interest account. Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase.

Sir car purchased in the name of our managing partner in the firm address. Car loan journal entry. In case of a journal entry for cash purchase Cash account and Purchase account are used.

8445 Points Replied 24 November 2018.

Solved Journal Entries For Fixed Asset Sale Vehicle With

Journal Entry To Separate Motor Vehicle Costs Myob Community

Financing New Company Vehicle Purchased With Trade In Of Old Vehicle General Discussion Sage 50 Accounting Canadian Edition Sage City Community

0 Response to "Car Purchase Journal Entry"

Post a Comment